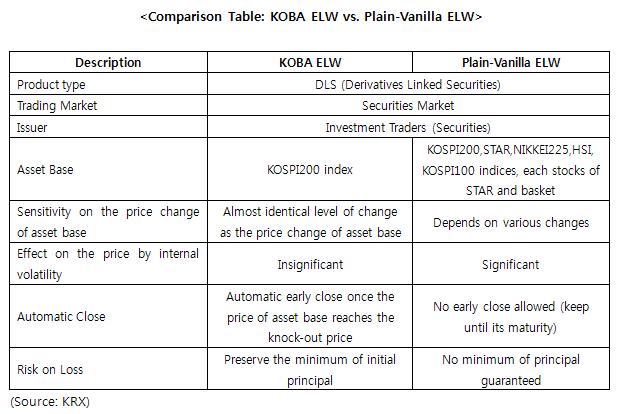

Since plain-vanilla ELW (Equity Linked Warrant) were introduced in 2005, private and institutional investors had been anxious to participate in trading because it is not only able to generate the significant profit over relatively a little investment – owning warrant to buying/selling right at the prearranged price of the share, but also able to invest in blue chips and hedge any potential risk with exercising call/put option as the price of share changes over the period. However, it created excessive losses on investors because ELW also does not guarantee any minimum amount of principal as investing in general stock or option. Also allegedly intentional speculation by notorious liquidity providers can trigger severe fluctuation of the price, which is regarded as an unfair transaction issue and lead to worsen the loss of investors.

For the sake of protect investors from loss on the excessive manipulation and preserve the least amount of investment, recently KOBA ELW was introduced at Korea Exchange (KRX). KOBA stands for Knock Out Barrier. Basically it is a supplementary version of the present plain-vanilla ELWs, which adds the option for automatic closing of the product once the price reaches the level of premeditated price range even before the maturity date. For instance, if you have call option – betting on upside potential, it is designed to close automatically once the price is being dropped below the certain level. On the other hand, if you have put option – betting on downside potential, it shall be closed automatically once the price is going up over the certain level.

The certain level means the minimum price range to preserve the amount of investment. Compared to plain-vanilla ELW, KOBA ELW should be able to preserve the minimum amount of investment in the worst case.

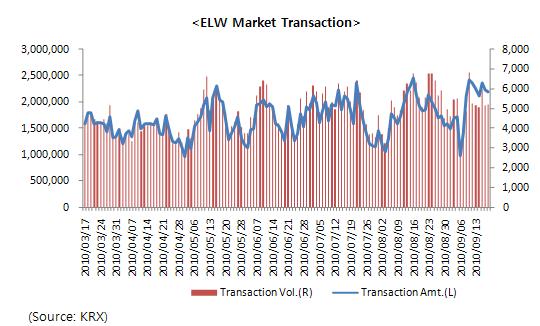

Since September 6, 2010, approximately 174 of KOBA ELW (including call/put) are listed and its market capital accounts for KRW 545.6 billion (more than 160% up since the beginning) as of September 16 based on the data provided by KRX. Even though KOBA ELW tackled the problem of plain-vanilla ELW, risk losing the total investment and successfully saved the minimum amount of investment, some argue that investors should be cautious on KOBA ELW still. Firstly, investors can still lose their money. In the worst case, 90% of investment can be lost, which means it doesn’t make any difference with plain-vanilla ELW. Secondly, once the price reaches knock out barrier, the transaction is shut down automatically without any further opportunity to recover its loss. Lastly, volatility can be soared as the price moves around knock out barrier, which could generate more losses than expected. However, basically KOBA ELW shall be moved along the target asset base, KOSPI200 index only, which is composed of mostly blue chips, the fluctuation of price expect to less volatile than other ELWs.

As an alternative version of plain-vanilla ELW, KOBA ELW expects to provide more secure investment environment for general investors preventing from severe losses of individual and contribute to facilitate ELW trading market in Korea. However, investors should keep in mind that it does not guarantee their investment and should be able to invest at their own risk without a doubt.

Jin Mok Kim (jinmok.kim@gmail.com)