The global economy is jumping on a new trend of “green growth”. Though efforts to propel green growth have not turned out to be much lucrative yet, it is allegedly expected to be of great value in terms of global competitiveness in a long run as a CSR activity. Considering such movement, President Lee Myung Bak declared to make green growth one of the top priorities to practice throughout his tenure years. Along with the government’s low carbon, green growth initiative, it is critical to support green industry with abundant capital. That is, green financing should be spotlighted with more weight and should be regarded as a key issue to gain momentum. As one year is left before the president leaves blue house, it is meaningful to briefly check how green growth policies have been effective and pave a way to boost green development, especially green financing.

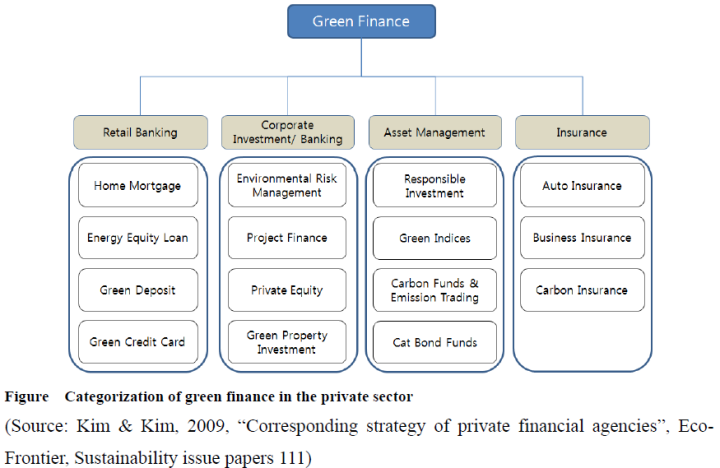

Green financing is largely categorized into two areas, individuals and companies, by the object of green financing. For individuals(private capital) participating in green financing activity, they can enjoy several benefits including higher interest rate on deposits, lower interest rate on loan, and fee discounts related to the personal green activities. For instance, in purchasing green products like hybrid vehicles, bikes and products that reduce carbon emission, personal loan is available. Also, bike insurance or insurance fee discounts by environmentally-friendly activities are provided. For companies, the finance products are mainly public loans, public funds such as matching fund of private and public investors, and guarantee. Professionals in industry pointed out corporations prefer low-interest lending most, followed by PF, R&D support, and guarantee by Korea Credit Guarantee Fund or Korea Technology Finance Corporation.

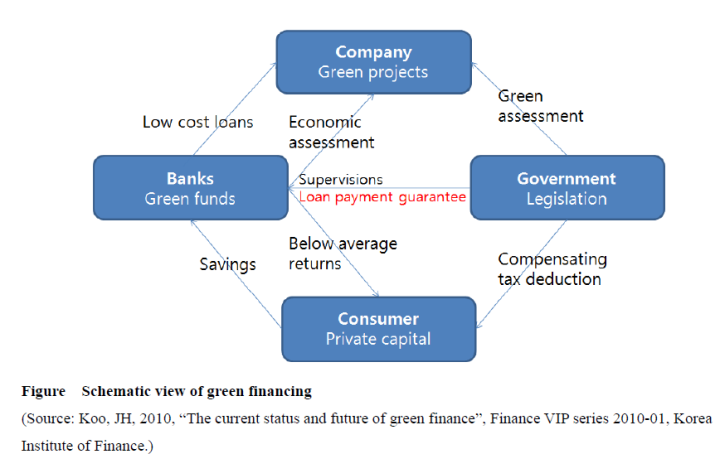

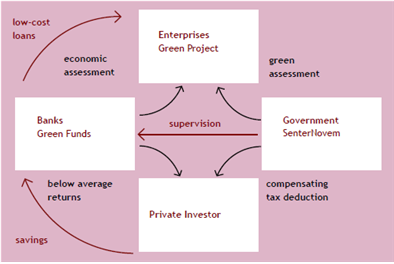

Korea benchmarked the Green Funds Scheme of Netherland in which the governmental support led the participation of private capital and elicited attention to green activities from diverse parties. Netherland started the Green Funds Schemes since 1995 and this plan was pushed forward by four governmental bodies (Ministry of Housing, Spatial Planning and the Environment, Ministry of Finance, Ministry of Agriculture, Nature and Food Quality, and Ministry of Transport, Public Works and Water Management). It is reported that the plan turned out to be successful among green financing programs in EU. Green certification, a channel approved by the government to certify the green technology, business and company, is fundamental in this scheme and in the process of adopting this green certification program in Korea, there are still rooms to revise and improve it. Specifically, requirements to receive green certificate should be less strict so that more small and middle sized firms can join “green certificate group” and be motivated to develop their technologies and products.

Green Funds Scheme

Diverse public policies associated with green financing have been announced and executed so far; yet, private sector has been showing lingering attitude towards this issue because of the risks involved in green industry.

Green-related loan offered by domestic banks is approximately 8.5trillion won but most of it is from public sectors including the Korea Development Bank, the Industrial Bank of Korea, Korea Finance Corporation and the Korea Exim Bank. Banks prefer public guarantee program since the government guarantees the corresponding loan payment, and most companies in green field are on the introductory stage, which means firms have not commercialized the products or technologies yet. Meanwhile, private financial institutions are not motivated as green financing accompanies a high risk and it is likely to take some time to withdraw the money invested into green industries which are in the beginning stage.

In order to tackle numerous challenges, uncertainty surrounding profits of green financing should be lessened and financial companies should be ensured that green financing could make profits in a short term as well with various green finance products. Moreover, green finance products such as green funds should be developed further and funding through Korea Finance Corporation should be increased to make the green financing policy successful. In terms of the green project finance which requires lots of capital, oversea support should be considered as well.

Corporate growth pattern should be taken into account to design long-term and effective green financing plans. In R&D stage before commercializing products, the company needs to consider a “death valley” where most startups are highly likely to fall down due to fund shortage. Consequently, the funding should be enough for startups to jump over the valley and after the jump-up, they should be able to access easily to the followings: green fund (i.e. green Small and medium enterprises fund), dividend income tax exemption for Green public offering fund, interest income exemption for green long term savings and bond, expansion of green bond portion in constituting the bond pool of liquidating and so on. Small and medium enterprises (SMEs) which have potentials to develop green technologies and products are more exposed to weak funding; the just-in-time(JIT) funding is significantly important. As the companies involved in the green sector step into further stages, funds from private capitals should be available as funds from the governmental side have limitations.

The US and UK governments are currently pursuing the establishment of a green-oriented investment firm. And there is a domestic move to bring the issue –the foundation of a financial company specialized in the green sector- to the table. While some experts argue that it is too early to decide, others insist that the earlier the establishment of a green bank which can provide a one-stop service about green financing, the better we are prepared for green investment. Rather than building up a new green bank, strengthening the role of Korea Finance Corporation might better fit into our situation where public sector is playing a vital role. Direct support from the government via R&D projects as well as credit guarantee by KIBO and KODIT should induce the private bank’s participation in a long run.

Financial institutions should take the initiative to control the risk of green industry by, for instance, putting a limitation on loan to environment-unfriendly business. A few banks in developed countries already took the actions. ABN AMRO Bank N.V., a Dutch state-owned bank, has been applying a social and ethical risk filtering system to sensitive business related to the environment. Japan Bank for International Cooperation also applied a standardized environmental frame when analyzing PF investment. UBS, a Swiss global financial services company, introduced “Environmental management capability assessment” first and took the lead in adding signatures to Carbon Disclosure Project. Although domestic banks have joined the rally, they seem to be at the starting point. Thus, Financial Services Commission is trying to put more emphasis on green-field analysis when evaluating banks on the basis of CAMMELS(Capital, Asset, Management, Earning, Liquidity, Sensitivity to market risk) so that the banks would be urged to improve green financing. Hopefully, with these attempts taken, Korea would be able to assimilate this brightly prospective green financing and successfully go “GREEN”.

By Lee, Ki Yeon

(kiyeon.m.lee@gmail.com)

I’ve been watching green investing take shape for about forty years! Global consciousness on this subject has changed radically in the past few years and is now more accepting than at any time previously. It’s clear that if we want an Earth to support our future generations, we have to begin to take care of it now.

For anyone interested in green and socially responsible investing, I have one of the most popular global sites on the subject. It also covers the latest related news and research too. It’s at http://investingforthesoul.com/

Best wishes, Ron Robins

Thanks for the comments, Mr.Robins. I’ve just visited the website you mentioned and it seems to be useful especially for the people who are interested in “green” or sustainable growth. I just skimmed through your website and could agree that investing in companies who decrease their carbon use and are efficient with resources will improve financial performance and stock values in a long term.. I, as a person who is currently working in a “Climate Change&Sustainability, Verification” department in a firm located in Korea, appreciate your comment.

Spot on with this write-up, I really think this site needs far more attention. I’ll probably be returning to see more, thanks for the info!

Having read this I thought it was really informative. I appreciate you finding the time and energy to put this informative article together. I once again find myself spending a significant amount of time both reading and leaving comments. But so what, it was still worthwhile!